In today’s digital age, mobile payment apps have become an essential part of our daily financial transactions. Let’s learn more about this topic below with Word Search and explore the key differences between two popular payment platforms.

Cash App and Venmo are both peer-to-peer payment services that allow users to send and receive money instantly. Cash App, developed by Square Inc., launched in 2013 and has evolved to include features like cryptocurrency trading and stock investments. Venmo, owned by PayPal, debuted in 2009 and has become known for its social feed feature that makes payments feel more interactive and engaging.

Both apps serve similar primary functions but differ significantly in their additional features, user experience, and target audience. Cash App tends to focus more on financial services and investment options, while Venmo emphasizes the social aspects of payments, making it popular among younger users who frequently split bills or share expenses with friends.

Cash App features a minimalist, straightforward interface with a clean design that prioritizes functionality. The home screen displays your balance prominently and provides quick access to essential features like sending money, investing, and accessing your Cash Card. The app’s navigation is intuitive, making it easy for users to complete transactions without unnecessary complexity.

Venmo’s interface is more social-media-oriented, with a Facebook-like feed showing public transactions (unless set to private). The app’s design is colorful and engaging, with emoji support and the ability to add comments to transactions. While some users appreciate this social aspect, others might find it distracting or prefer more privacy in their financial transactions.

Read more: YNAB (You Need A Budget) App Review: Worth the Price?

Both apps implement strong security measures to protect users’ financial information. Cash App offers security features like Face ID, Touch ID, and PIN entry requirements. It also provides two-factor authentication and the ability to disable your Cash Card instantly if lost or stolen. The app encrypts all data and complies with PCI-DSS Level 1 certification requirements.

Venmo also employs encryption and offers similar authentication options. However, its default public transaction feed has raised privacy concerns. Users must manually change their settings to make transactions private, which some critics argue should be the default option. Both apps provide fraud protection, though they handle disputed transactions differently.

Cash App’s basic services are free, including sending and receiving money between users. Instant transfers to bank accounts incur a 1.5% fee, while standard transfers are free but take 1-3 business days. The Cash Card is free and can be used anywhere Visa is accepted. Bitcoin purchases include a small fee, and stock investments are commission-free.

Venmo’s standard transfers are also free between users and to linked bank accounts (1-3 business days). Instant transfers cost 1.75% of the transfer amount. The Venmo credit card has no annual fee, and the debit card is free. Both apps charge fees for credit card transactions: 3% for Cash App and 3% for Venmo.

Cash App distinguishes itself with investment features, allowing users to buy and sell stocks and Bitcoin directly through the app. The Cash Card offers “Boosts,” which are instant rewards and discounts at selected merchants. Users can also receive direct deposits, including paychecks, up to two days earlier than traditional banks.

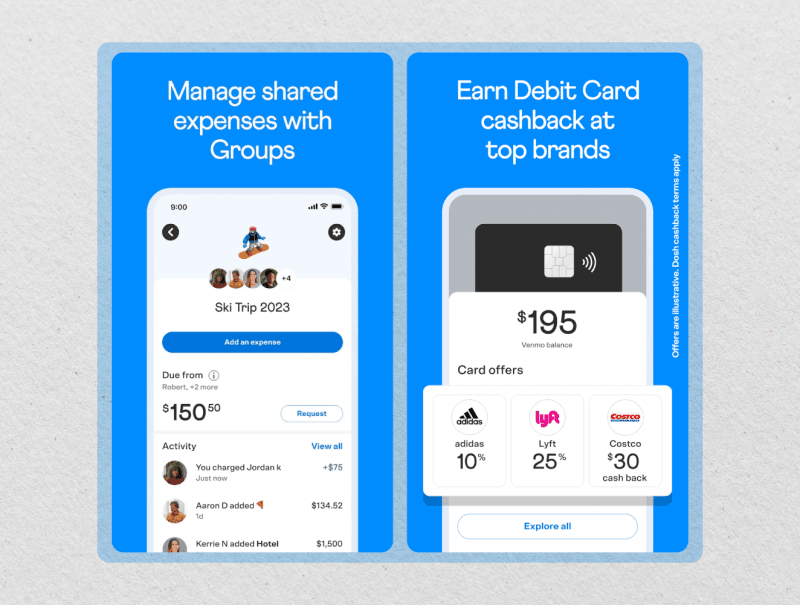

Venmo offers its own credit and debit cards, crypto trading capabilities, and business profiles for merchants. The app’s social feed enables users to split bills easily and keep track of shared expenses. Venmo also provides QR code payments and the ability to make purchases at millions of online retailers.

Both apps are available for iOS and Android devices and can be accessed through web browsers, though with limited functionality compared to mobile versions. Cash App works seamlessly across devices and platforms, maintaining consistent performance and feature availability.

Venmo’s cross-platform experience is equally smooth, though some features like the social feed are better optimized for mobile use. Both apps sync well with other financial services and maintain stable connections across different devices and operating systems.

Cash App provides customer support through their app, website, and social media channels. Response times can vary, but the app offers comprehensive FAQ sections and troubleshooting guides. Users can also contact support through email or phone for more serious issues.

Venmo’s customer service is similar, offering support through multiple channels. The app provides detailed help articles and responsive customer service representatives. Both platforms have improved their support systems over time, though users occasionally report delays in resolution times for complex issues.

Cash App is better suited for users who prioritize investment opportunities and want a more straightforward payment experience. It’s ideal for those who value privacy and prefer a clean, minimalist interface. The app’s Boost features and early direct deposit options make it attractive for regular users seeking additional financial benefits.

Venmo works best for users who enjoy the social aspects of payments and frequently split expenses with friends. Its intuitive interface and social features make it popular among younger users and those who value the community aspect of financial transactions. The app’s business profiles also make it suitable for small merchants and service providers.

Read more: Best Investment Apps for Beginners (with Low Fees)

Both Cash App and Venmo are robust mobile payment platforms with distinct advantages. Choose Cash App if you want a more comprehensive financial tool with investment options and prefer privacy in your transactions. Its clean interface and Boost rewards make it particularly attractive for regular users who want to maximize their benefits.

Opt for Venmo if you frequently split bills with friends and enjoy the social aspects of payments. Its user-friendly interface and widespread adoption make it ideal for group expenses and social transactions. Consider your primary use case, preferred features, and privacy preferences when making your choice. Remember that you can always use both apps to take advantage of their unique features and benefits.